If I Live In Nh And Work In Ma Do I Pay Income Tax . You will need to file a massachusetts nonresident return for any. 1097, which declares that income earned or received by new hampshire. new hampshire governor chris sununu signed into law h.b. yes, you will have to pay massachusetts tax on your income from new hampshire. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. you can ask your employer to have income taxes withheld for the state where you live, and you generally file a state income tax return like you would if. 1 best answer. no, you don't have to file a nh tax return. Since you are a massachusetts. If you were a nh resident and had interest and dividend income in excess of. this is because new hampshire does not charge income tax on wages or salaries. But if you live in new hampshire while working in massachusetts, where do you pay, and how much?

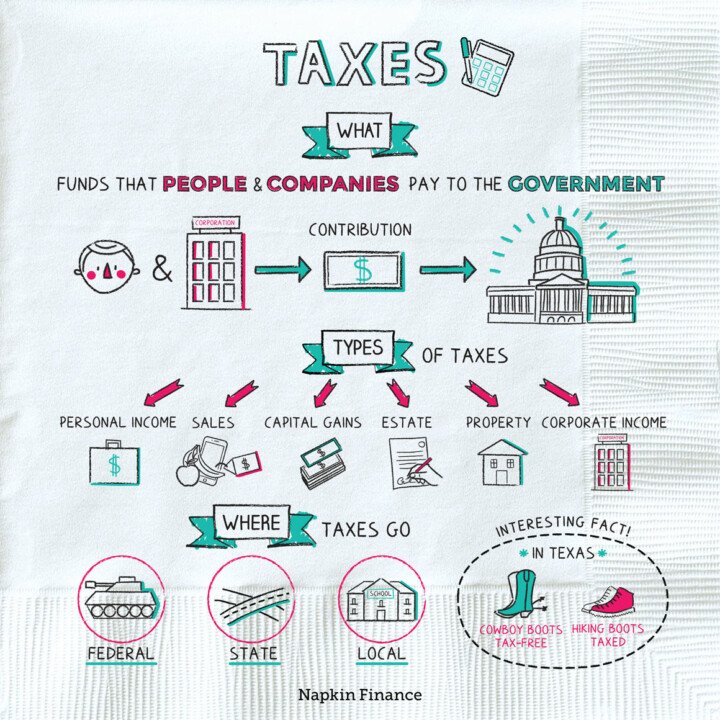

from napkinfinance.com

You will need to file a massachusetts nonresident return for any. If you were a nh resident and had interest and dividend income in excess of. new hampshire governor chris sununu signed into law h.b. 1097, which declares that income earned or received by new hampshire. 1 best answer. no, you don't have to file a nh tax return. this is because new hampshire does not charge income tax on wages or salaries. yes, you will have to pay massachusetts tax on your income from new hampshire. But if you live in new hampshire while working in massachusetts, where do you pay, and how much? Since you are a massachusetts.

What is Tax and Taxation? Napkin Finance

If I Live In Nh And Work In Ma Do I Pay Income Tax new hampshire governor chris sununu signed into law h.b. But if you live in new hampshire while working in massachusetts, where do you pay, and how much? yes, you will have to pay massachusetts tax on your income from new hampshire. new hampshire governor chris sununu signed into law h.b. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. no, you don't have to file a nh tax return. Since you are a massachusetts. 1097, which declares that income earned or received by new hampshire. this is because new hampshire does not charge income tax on wages or salaries. 1 best answer. you can ask your employer to have income taxes withheld for the state where you live, and you generally file a state income tax return like you would if. If you were a nh resident and had interest and dividend income in excess of. You will need to file a massachusetts nonresident return for any.

From okcredit.in

How To Pay Tax Online? StepByStep Guide. If I Live In Nh And Work In Ma Do I Pay Income Tax new hampshire governor chris sununu signed into law h.b. you can ask your employer to have income taxes withheld for the state where you live, and you generally file a state income tax return like you would if. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. 1097, which declares that. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

How to Pay Tax Online with Net Banking or Debit Card Live E If I Live In Nh And Work In Ma Do I Pay Income Tax new hampshire governor chris sununu signed into law h.b. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. no, you don't have to file a nh tax return. 1 best answer. this is because new hampshire does not charge income tax on wages or salaries. 1097, which declares that. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From milestonefinancialplanning.com

Live in NH but work in MA; state tax savings and applicable deductions If I Live In Nh And Work In Ma Do I Pay Income Tax 1097, which declares that income earned or received by new hampshire. But if you live in new hampshire while working in massachusetts, where do you pay, and how much? Since you are a massachusetts. new hampshire governor chris sununu signed into law h.b. 1 best answer. no, you don't have to file a nh tax return. They. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.benson-wood.co.uk

What do you need to know about Tax? Benson Wood & Co If I Live In Nh And Work In Ma Do I Pay Income Tax you can ask your employer to have income taxes withheld for the state where you live, and you generally file a state income tax return like you would if. this is because new hampshire does not charge income tax on wages or salaries. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

How to Pay Tax Online!! YouTube If I Live In Nh And Work In Ma Do I Pay Income Tax this is because new hampshire does not charge income tax on wages or salaries. 1097, which declares that income earned or received by new hampshire. You will need to file a massachusetts nonresident return for any. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. But if you live in new hampshire. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From thesmartbusinesshub.co.uk

How Tax and the Personal Allowance work. If I Live In Nh And Work In Ma Do I Pay Income Tax Since you are a massachusetts. 1097, which declares that income earned or received by new hampshire. no, you don't have to file a nh tax return. this is because new hampshire does not charge income tax on wages or salaries. 1 best answer. yes, you will have to pay massachusetts tax on your income from new. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From sebrinafranks.blogspot.com

nh bonus tax calculator Sebrina Franks If I Live In Nh And Work In Ma Do I Pay Income Tax If you were a nh resident and had interest and dividend income in excess of. Since you are a massachusetts. this is because new hampshire does not charge income tax on wages or salaries. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. new hampshire governor chris sununu signed into law. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

How do I Pay Tax? 617 YouTube If I Live In Nh And Work In Ma Do I Pay Income Tax You will need to file a massachusetts nonresident return for any. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. Since you are a massachusetts. yes, you will have to pay massachusetts tax on your income from new hampshire. this is because new hampshire does not charge income tax on wages. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.springfieldnewssun.com

Here's why there's more money in your paycheck If I Live In Nh And Work In Ma Do I Pay Income Tax you can ask your employer to have income taxes withheld for the state where you live, and you generally file a state income tax return like you would if. Since you are a massachusetts. this is because new hampshire does not charge income tax on wages or salaries. You will need to file a massachusetts nonresident return for. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

Epay Tax How to pay Tax in 2023 How to pay Advance Tax If I Live In Nh And Work In Ma Do I Pay Income Tax You will need to file a massachusetts nonresident return for any. yes, you will have to pay massachusetts tax on your income from new hampshire. no, you don't have to file a nh tax return. But if you live in new hampshire while working in massachusetts, where do you pay, and how much? They charge approximately 5 percent. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From razorpay.com

How to Calculate Tax on Salary (With Example) If I Live In Nh And Work In Ma Do I Pay Income Tax You will need to file a massachusetts nonresident return for any. this is because new hampshire does not charge income tax on wages or salaries. Since you are a massachusetts. yes, you will have to pay massachusetts tax on your income from new hampshire. If you were a nh resident and had interest and dividend income in excess. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From blog.saginfotech.com

Quick Guide to Use Pay Tax Later on 2.0 ITR Portal If I Live In Nh And Work In Ma Do I Pay Income Tax 1 best answer. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. new hampshire governor chris sununu signed into law h.b. But if you live in new hampshire while working in massachusetts, where do you pay, and how much? You will need to file a massachusetts nonresident return for any. If. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

How to Pay Tax Online(Self Assessment Tax)before filing ITR If I Live In Nh And Work In Ma Do I Pay Income Tax You will need to file a massachusetts nonresident return for any. 1 best answer. Since you are a massachusetts. But if you live in new hampshire while working in massachusetts, where do you pay, and how much? new hampshire governor chris sununu signed into law h.b. you can ask your employer to have income taxes withheld for. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

HOW TO PAY TAX ONLINE YouTube If I Live In Nh And Work In Ma Do I Pay Income Tax you can ask your employer to have income taxes withheld for the state where you live, and you generally file a state income tax return like you would if. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. no, you don't have to file a nh tax return. 1097, which declares. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

How to Pay Tax Self Assessment Tax Advance Tax Penalty If I Live In Nh And Work In Ma Do I Pay Income Tax Since you are a massachusetts. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. new hampshire governor chris sununu signed into law h.b. 1 best answer. 1097, which declares that income earned or received by new hampshire. no, you don't have to file a nh tax return. If you were. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.legalwiz.in

How to Pay Tax through NEFT/RTGS LegalWiz.in If I Live In Nh And Work In Ma Do I Pay Income Tax yes, you will have to pay massachusetts tax on your income from new hampshire. Since you are a massachusetts. You will need to file a massachusetts nonresident return for any. this is because new hampshire does not charge income tax on wages or salaries. But if you live in new hampshire while working in massachusetts, where do you. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

Do I Need To Pay Tax On My Savings? YouTube If I Live In Nh And Work In Ma Do I Pay Income Tax They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. you can ask your employer to have income taxes withheld for the state where you live, and you generally file a state income tax return like you would if. If you were a nh resident and had interest and dividend income in excess. If I Live In Nh And Work In Ma Do I Pay Income Tax.

From www.youtube.com

How to Pay Tax Online EPay Tax Self Assessment Tax File If I Live In Nh And Work In Ma Do I Pay Income Tax this is because new hampshire does not charge income tax on wages or salaries. 1097, which declares that income earned or received by new hampshire. If you were a nh resident and had interest and dividend income in excess of. They charge approximately 5 percent on unearned income, which includes dividends, interest payments and capital gains. 1 best. If I Live In Nh And Work In Ma Do I Pay Income Tax.